-

Find and Test-Drive a U.S. Leader

DELIGHT is joining the Founder Institute Find and Test-Drive a Co-Founder bootcamp — not because we are looking for a...

-

Accelerating Our Global Expansion Through J-StarX — Starting December 2

We’re excited to announce that we have been officially shortlisted for the J-StarX Local to Global Success Program, o...

-

We’ve Been Shortlisted for J‑StarX AI Go‑To‑Market (GTM) Program — Cohort Starts December 1

We’re excited to announce that our startup has been officially shortlisted for the J-StarX AI Go-To-Market (GTM) Prog...

-

From Idea-Stage or MVP Founder to Global Startup Founder

— A Non-Native Founder’s Practical Guide

Introduction

This article is written from the perspective of a non-native E...

-

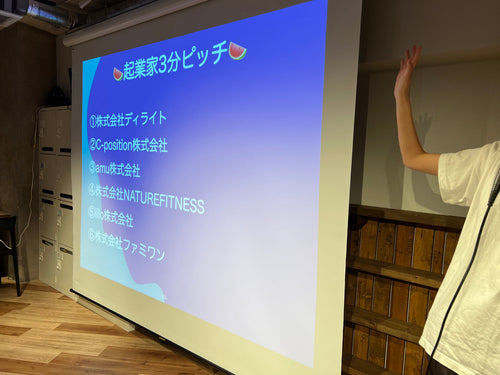

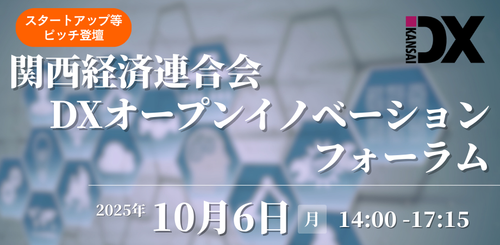

DELIGHT to Present at the Kankeiren DX Open Innovation Forum 2025

We’re excited to share that DELIGHT will pitch at the Kankeiren (Kansai Economic Federation) DX Open Innovation Forum...

-

DELIGHT Chosen for X-HUB Tokyo → Pitch at TechCrunch Disrupt

We are thrilled to announce that DELIGHT has been selected for the X-HUB Tokyo Outbound Program: Silicon Valley Cours...

-

Our CEO to Share Insights on Estonia’s e-Residency Program

Expanding Business in Europe, Digitally from Japan

Our CEO, Hiroyuki Anno, became an e-Residency holder of Estonia in...

-

Learning and Growth at 500 Global Tokyo Accelerator

We recently had the opportunity to participate in the 500 Global Accelerator Program in Tokyo. Over the past few year...

-

DELIGHT Selected for Sido Next Innovator Program 2025

We are excited to share that DELIGHT has been selected for “Sido Next Innovator,” Japan’s premier government-backed i...

-

DELIGHT Global Accepted into Google for Startups Cloud Program

We’re excited to share that DELIGHT Global Inc. has been approved for the Google for Startups Cloud Program.

Through ...

-

What Is the Founder Institute (FI)? A Personal Introduction from a Graduate

As a proud FI graduate myself, I’d like to take this opportunity to properly introduce what FI is and what makes it s...

-

The Day I Lost My Balance After 30 Years of Perfect Health

── A wake-up call for every startup founder

From our founder

For over 30 years, I hardly ever caught a cold, never su...

-

Kicking Off with Aspire Ignite: DELIGHT Joins First Singapore Cohort

We are excited to share that DELIGHT has been selected for the first Aspire Ignite Cohort in Singapore!

Aspire Ignite...

-

Perspectivas del Fundador: Un Viaje de Transformación de Startups en el Founder Institute

Aquí hay un artículo de nuestro CEO sobre el mundo de las startups. El Founder Institute realmente cambió mi menta...

-

Oportunidades y Riesgos en el Mercado Japonés: La Perspectiva de un Fundador Japonés en el Extranjero

Como fundador japonés que vive en el extranjero, he tenido el privilegio—y el desafío—de observar el mercado japonés ...

-

Información imprescindible para fundadores de startups que se trasladan a Singapur

Aquí hay un artículo de nuestro Fundador. Hoy, me gustaría compartir información esencial para los fundadores de s...

-

Manteniendo la Salud Bajo Presión: Consejos para Compañeros Fundadores

Como fundadores, operamos constantemente bajo una intensa presión sin la opción de "cambiar de trabajo". Si hay inver...

-

Cómo elegir una aceleradora de startups

Este es un artículo de nuestro fundador Hiroyuki ANNO para compartir su experiencia como fundador de una startup.Cómo...

-

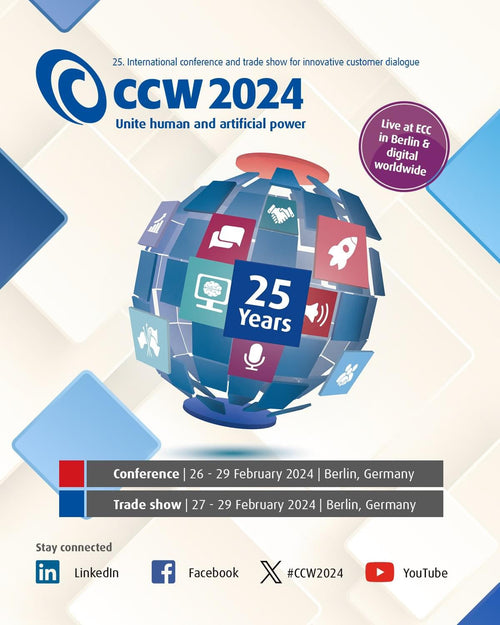

¡Emocionados de Compartir Nuestra Reciente Experiencia de Presentación!

Tuvimos una oportunidad increíble de presentar y mostrar nuestra empresa a inversores y clientes potenciales en la se...

-

Exhibición de fundadores asiáticos: evento de presentación de fundadores locales

¡Nos complace anunciar que próximamente tendremos una oportunidad de presentación! El Local Founder Showcase es un...

-

El viaje de DELIGHT a través de la cohorte Boost de Moon Creative Lab

Durante los últimos seis meses, nuestro equipo en DELIGHT ha tenido el privilegio de formar parte del grupo de impul...

-

Maximizar las oportunidades posteriores al programa: conocimientos del laboratorio de financiación

Después de graduarme de la cohorte japonesa del Founder Institute en 2023, me embarqué en otro viaje enriquecedor con...

-

DELIGHT Takes Europe: seleccionado para el programa exclusivo de apoyo empresarial de JETRO

Nos complace anunciar que hemos sido seleccionados para el programa J-StarX de JETRO Innovation, "Apoyo empresar...

-

Trazando nuevos horizontes en FinTech: el viaje de DELIGHT hacia FINOPITCH 2024

Estamos encantados de anunciar nuestra participación como finalistas en la 12ª edición del concurso de pitcheo “FINOP...

-

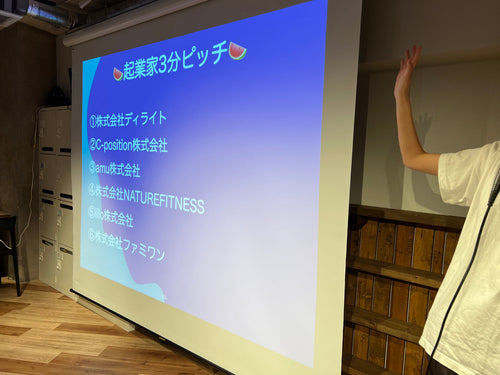

Evento de presentación en Morning Meetup

Nos complace anunciar que nuestro CEO, Hiroyuki Anno, asistió a la reunión matutina en Osaka.

Para más detalles:

http...

-

DELIGHT honrada como empresa de más rápido crecimiento en 2023 por el Founder Institute

Somos encantado de anunciar su reconocimiento como una de las prestigiosas empresas FI 50, destacando su notable crec...

-

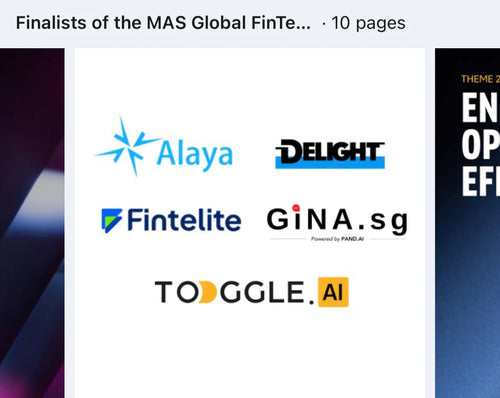

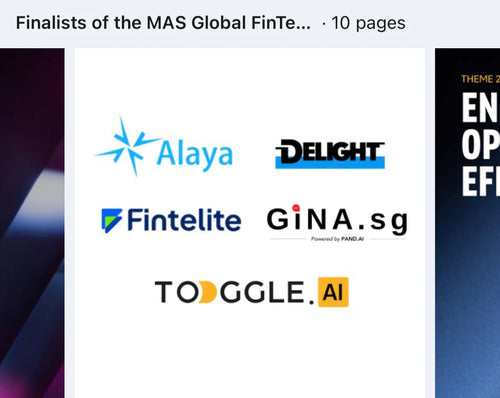

SELECCIONADO E INVITADO AL FESTIVAL FINTECH EN SINGAPUR

Nos sentimos honrados de anunciar nuestra participación en el HACKCELERATOR del DESAFÍO GLOBAL DE IA EN FINANZAS 2023...

-

LTS Y DELIGHT FORTALECEN COLABORACIÓN EN EL AVANCE DEL CALL CENTER DX

Compañía: LTS, Inc. (Sede: Minato-ku, Tokio, CEO: Hiroaki Kabashima / en adelante LTS) se complace en anunciar su co...

-

SELECCIONADO COMO EL PORTAFOLIO SELECTO DEL INSTITUTO FUNDADOR

Nos complace anunciar que hemos sido seleccionados como Portafolio Selecto del Instituto Fundador.Es una designación...

-

PRESENTACIÓN EN "CVC X FIESTA DE NETWORKING DE MEDIANO VERANO PARA EMPRENDEDORES"

Nos complace anunciar que nuestro CEO, Hiroyuki Anno, presentó en la Fiesta de Networking de Verano CVC x Emprendedor...